CM Punjab Madam Maryam Nawaz Asaan Karobar Finance Scheme 2025

CM Punjab Madam Maryam Nawaz has launched Asaan Karobar Finance Scheme for the support of those entrepreneurs and small businesses owners who want to start or expand their business. In accordance with this initiative, CM Punjab is also ready to empower Small and Medium Enterprises (SMEs) and to increase economic growth through interest free loans and flexible financing options. It focuses on priority sectoral development across the province, stimulating economic growth through entrepreneurship and job creation, and export.

Also Read about CM Punjab Madam Maryam Nawaz Asaan Karobar Card 2025

Loan Purpose

- New Businesses: Startup funding

- Existing Businesses: Expansion of business, streamlining the business, or getting working capital

- Leasing: Commercial logistics

- RECP Technologies: Climate friendly businesses

Key Features of Asaan Karobar Finance Scheme

- Massive Allocation:

- Total Fund: PKR 84 billion

- Business Card Scheme: PKR 48 billion

- Interest-Free Loans: PKR 66 billion

- Loan Amount Range:

- Minimum Loan: PKR 100,000

- Maximum Loan: PKR 10 million

- Interest-Free Loans:

- providing relief to entrepreneurs financially.

- This loan solution serves entrepreneurs who want to build or grow their businesses beyond financial interest concerns.

- Repayment Plan:

- 60 monthly instalments and a flexible repayment period up to 5 years.

Eligibility Criteria

- Small Enterprises with annual sales up to PKR 150M

- Medium Enterprises with annual sales > PKR 150M – PKR 800M

- Age: 25-55 years

- Active FBR tax filers with clean credit history

- Residence and business located in Punjab

- Valid CNIC and NTN

- Must own / have rented the place of existing business

Loan Details, Tiers, Repayment Terms and Additional Costs for Asaan Karobar Finance Scheme

Grace Period for Asaan Karobar Finance Scheme:

- Grace period is up to 6 months for start-ups / new businesses and up to 3 months for existing businesses.

Equity Contribution:

- 0 % for T1 other than leased commercial vehicles

- Leased Vehicles: 25%

- Other Loans: 20% in all other cases under T2

- 10% for females, transgender and differently-abled persons

Repayment Terms for Asaan Karobar Finance Scheme :

- Equal monthly installments as per terms of the approval

- Late Charges: PKR 1 per 1000/day on overdue amounts

Additional Costs for Asaan Karobar Finance Scheme:

- Handling fee

- NIL for setting-up new business

- 3% p.a for existing businesses

- NIL p.a for climate-friendly businesses in (T2 only)

- Insurance, legal and registration charges apply as per actual costs.

Required Documents for the Asaan Karobar Finance Loan Scheme

You must have scanned copies or clear visible pictures of the following documents ready before you start your application:

- Passport Size Picture / Selfies

- CNIC – Front Side

- CNIC – Back Side

Ensure the following documents before starting your application:

- A Mobile Number Registered with your CNIC.

- Names, copies of CNIC, and mobile numbers of two references (not blood relatives).

- You are an Active Tax Filer.

- Details of business income and expenses as per requirement.

- Copy of Rent Agreement/ Transfer Letter/ Registry for Business and Residence Addresses, whatever applicable is available.

- Make sure you meet the criteria.

- You must have the Application Fee available.

- You must have the Detail of Security to be offered for T2 Loans e.g. Property Transfer Letter / Registry / Fard / Government Securities etc.

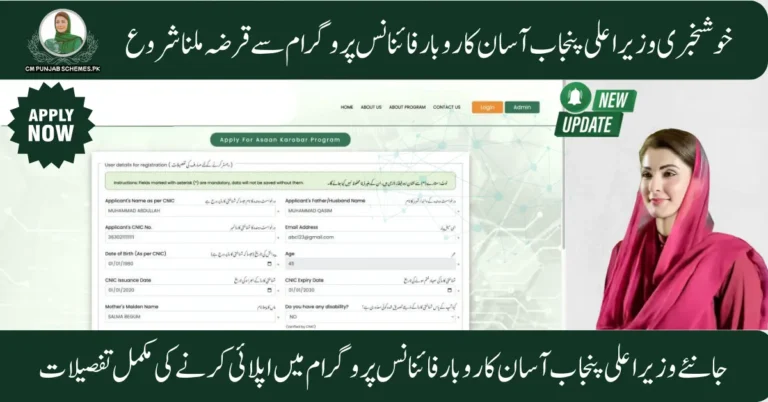

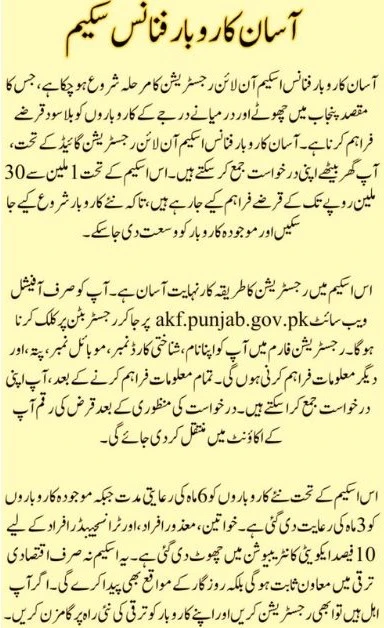

Asaan Karobar Finance Scheme Registration/Submission Process

- Please sign up to submit the application on https://akf.punjab.gov.pk/cmpunjabfinance.

- Click on the “Acknowledge and proceed” button after reading details

- You must have a mobile number registered in your name to start the application.

- This application will take at least 15 minutes to complete.

- You may complete the form in one go or save a draft for submission later on.

- press the “Register” button to proceed

- Upload as much information as possible included (like Financial Statements, Business Feasibility, etc.)

- Processing on your application shall begin after submitting the complete form and Depositing the Fee.

- Application Submission Fees for Tier 1 is PKR 5,000 (Fees is Non-Refundable)

- Application Submission Fees for Tier 2 is PKR 10,000 (Fees is Non-Refundable)

- Once submitted, your application registration number will appear on the screen and via SMS.

- You will receive SMS updates or check the status on the website.

Application Process Asaan Karobar Card Finance Loan Scheme

potential applicants can apply online through the official portal akf.punjab.gov.pk. Digital application process is also a more efficient way of submitting documents and lets users track their application status easily..

Additional Support Mechanisms

To further assist businesses, the Punjab government has introduced complementary measures:

- Asaan Karobar Card: The Digital SME Card offers interest free loans up to Rs.1 million, a tenure of three years and a grace period of three months. With the card, business to business transactions are facilitated through digital platforms, and this creates financial inclusion and operational efficiency.

- Capital Subsidies: Subsidies of up to Rs 5 million are provided to entrepreneurs who adopt solar equipment and cleaner production technologies, in support of sustainable business practices.

- Industrial Estate Development: Across the Province, new small industrial estates are being established in key areas with affordable plots on long term (up to 30 years) leases meaning businesses have the infrastructure required for expansion.

Impact on Large-Scale Businesses

The Asaan Karobar Finance Scheme is poised to significantly impact large-scale enterprises by:

- Facilitating Expansion: Large businesses have ample access to massive interest free loans, which in turn can be used to install new technologies, expand production and gain access to larger markets.

- Promoting Export Growth: Free solar systems are one of the incentives given to industries in export processing zones, aimed to promote exports and ensure that Punjab generates worldwide competitive industries.

- Encouraging Sustainable Practices: Sustainable practice is promoted by capital subsidies for clean technologies, increasing environmental impact and corporate responsibility among large businesses.

Benefits of the Asaan Karobar Finance Scheme

- Interest-Free Loans: get a loan without worrying about high interest rates.

- Streamlined Registration: Online application ensures easy access.

- Inclusive Program: Special benefits for women, transgender individuals, and differently-abled persons.

- Support for Green Businesses: Incentives for the individuals that are working for climate-friendly projects.

- Economic Growth: Helps to create jobs to boost the economy.

Common Mistakes to Avoid

Make sure you Submit required documents properly, must double-check your CNIC, mobile number, and email before final submission , and must remember the registration date to avoid deadlines.

Future Outlook of the Asaan Karobar Finance Scheme

Suggestions for Improvement and Expansion

Stakeholders suggest that awareness can be enhanced through workshops and the scope of businesses supported can be expanded. It could encourage even more entrepreneurs.

The Scheme’s Role in Punjab’s Long-Term Economic Development

Punjab’s economic strategy is incomplete without the Asaan Karobar finance scheme. It fuels sustainable growth of and potential future job creation for people of punjab through empowering entrepreneurs

FAQs about CM Punjab Maryam Nawaz’s Asaan Karobar Finance Scheme

Conclusion

Chief Minister Maryam Nawaz Asaan Karobar Finance scheme is a completely unique way of economic development of Punjab. The initiative is expected to provide substantial financial support and create an environment that is enabling for large scale businesses to lead a growth in industries, create employment opportunities, and assist in the province’s long term economic prosperity.

For more information and to apply, visit the official website: akf.punjab.gov.pk

Helpline: 1786